The stock market is not the economy. 2020 proved this statement repeatedly as COVID-19 swirled around the globe and caused a global drop in the markets. While the world was in travel restrictions and businesses were interrupted, the stock markets and investments continued to grow. In 2022, the economy kept marching forward, companies where profitable and the stock markets dropped into a bear market territory. How does that happen?

First, I will provide some explanation on how an index works and I will use the S&P 500 as an example. The S&P 500 is a collection of the 500 largest business listed on the New York Stock Exchange.

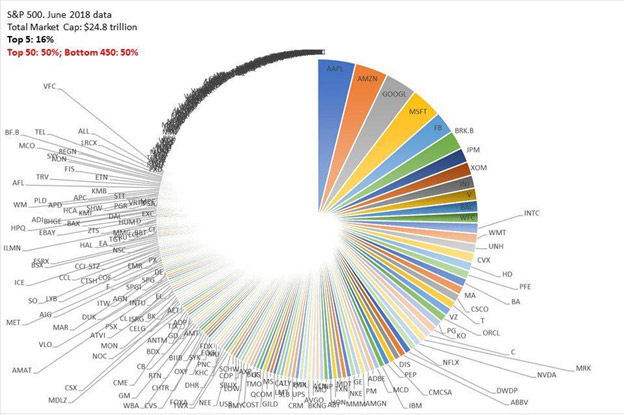

The S&P 500 Index reports the aggregate performance of these 500 companies, weighted by their market capitalization (plainly said, the larger the company, the more its individual performance affects the index). 20 years ago, most of the companies on the S&P 500 were of similar size. A few companies having good or bad days were not going to move the index. This is a visual representation of what the S&P 500 looked like in 2018.

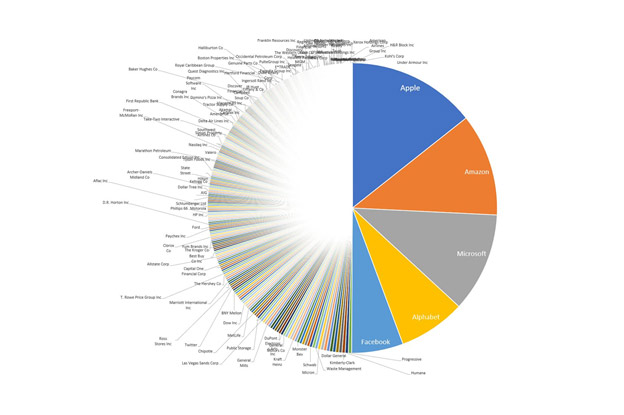

2020 is when things changed... alot. In 2020 we saw a meteoric rise in the size and scope of some large tech companies who provide us everyday services... even through a lockdown and global recession. Apple, Amazon, Alphabet, Facebook and Microsoft shifted the way that the index performs. In 2020, these ‘MegaCap’ stocks grew to represent almost 50% of the entire S&P 500 (see visual representation next).

What does this mean? It means 20 years ago when the markets/indexes moved, it gave an indication of how a collection of 500 businesses were doing financially. Today? It means that 5 large tech companies could be having a good or a bad day……and moving the index in the opposite direction of the general economy.

I give you this background to answer the question that I was asked so many times in 2020... HOW COME THE MARKETS ARE GOING UP BUT MY MUTUAL FUNDS AREN’T???

The honest answer is that the companies in your mutual funds may not be invested in the same types of rapid growth, high priced stocks that make up the S&P 500, or the Nasdaq. In simple terms, they are disconnected.

We ask our portfolio managers every day to find good companies to invest in that will go up in value. Buying overly expensive companies because everyone else is buying them is not the way to build long term wealth. Buying companies that can spike in value is a risky venture. Buying companies that have a long runway for growth is the way to build true wealth. Building wealth is a marathon, not a sprint.

Very few of the companies that are invested in our mutual funds are represented in the indexes. The major market indexes will give a general direction on which way investors are feeling, and I don’t suggest we ignore the indexes completely.

BUT

They are disconnected from the economy.

Keep Investing.